Rewards Plan

Sign up Bonus

Our Rating

0% Intro

Annual Fee

APR

- Impressive Credit Limit:

- Minimal Fees

- Limited Reporting

- No Instant Approval

Rewards Plan

Sign up Bonus

Our Rating

PROS

- Impressive Credit Limit:

- Minimal Fees

CONS

- Limited Reporting

- No Instant Approval

APR

19.99% - 29.99% (Variable)

Annual Fee

$395

0% Intro

N/A

Credit Requirements

Good - Excellent

- Our Verdict

- FAQ

The Capital One Venture X Rewards Credit Card is a premium travel card ($395 annual fee) and can be a perfect fit for travelers who want to extra travel perks such as airport lounge access, travel insurance protection, and special rental car privileges, in addition to a better rewards rates. This is the most premium card among Capital one credit cards.

The Venture X earns 10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases. New applicants can also get 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening, and there is no foreign transaction Fee.

Additional perks include Hertz President's Circle status, Global Entry or TSA PreCheck credits, trip delay reimbursement, cellphone protection, and primary rental car insurance.

The card is mainly focused on travel and therefore, less relevant for those who are looking for everyday purchases rewards or rotating categories. Also, cardholders who aren't sure they can cover the high annual fee, need to look for a cheaper travel card.

How’s the card customer service availability?

Capital One has a customer service line that is available 24/7, so you can access help at any time of the day or night.

What are the top reasons NOT to get the Venture X Card?

The main reason not to get the Capital One Venture X is the higher annual fee. The fee is $395 and the card offers limited travel insurance options to offset this fee.

How long does it take for approval?

Capital One aims to give an approval decision within a few minutes, unless additional information is required to support your application. In this case, it can take a further 7 to 10 days. After approval, you should receive your card within 10 days.

How much miles can I earn?

There are no caps or limits to how many miles you can earn.

In this Review

Benefits

- $300 Annual Credit

All Venture X reward members will get $300 back (annually) in their statement credits to be used for travel.

This is a great benefit if you want to travel and you need some financial help to do so. It’s also a great incentive to make sure you are taking your yearly trip.

This is a great bonus. For example, the Chase Sapphire Reserve annual travel credit is quite similar.

- $100 Experience Credit

Customers enjoy a $100 experience credit, daily breakfast for two, and premium benefits, along with earning 10X miles on hotel stays booked through Capital One Travel.

- Hertz Gold Plus Rewards President's Circle® status

Venture X cardholders are eligible for complimentary Hertz President’s Circle status, allowing them to skip the rental counter, choose from a wide selection of cars, and receive guaranteed upgrades.

- Referrals Bonus

Refer friends and family to apply for a Venture X card and earn up to 100,000 bonus miles when they're approved.

- Visa Infinite Concierge

A Visa Infinite concierge will help make the reservation and more, like line up live stage shows, music or sporting event tickets.

- Capital One Lounges

Cardholders enjoy unlimited access for yourself and two guests to over 1,300 lounges worldwide from Priority Pass™ and Plaza Premium Group.

- Complimentary PRIOR Subscription

Cardholders receive a complimentary PRIOR Subscription worth $149, offering access to extraordinary travel experiences and destination guides.

- 10,000 Miles Anniversary Bonus

Cardholders receive 10,000 bonus miles (equal to $100 towards travel) every year, starting on their first anniversary.

- Global Entry or TSA PreCheck® Credit

Receive up to a $100 credit for Global Entry or TSA PreCheck®.

Partner Lounge Network

- Lifestyle Collection

Unlock premium benefits with every hotel stay, including a $50 experience credit, room upgrades when available, and earning 10X miles on hotel stays booked through Capital One Travel.

- Free Additional Cardholders

Add cardholders to your account for free, allowing them to enjoy benefits while you earn rewards on their spending.

Drawbacks

- No Upgrading or Elite Status

There is no upgrading or elite status compared to other cards. No matter how long you own the card or how many points you use, you will always be at the same tier.

- Smaller Network

The airline and hotel partners are limited compared to other cards, although they have improved within the recent years with some additions. You might not be able to find the airline you normally fly with.

- Redeeming on Capital One Travel

You can only use the $300 annual statement credit for purchases made through Capital One travel, similar to Amex and Chase travel cards where you need to order via the Amex memebership club or the Chase ultimate rewards.

This means you can’t use it by booking travel on other websites. You will need to find your travel deals through the Capital One Travel credit card portal.

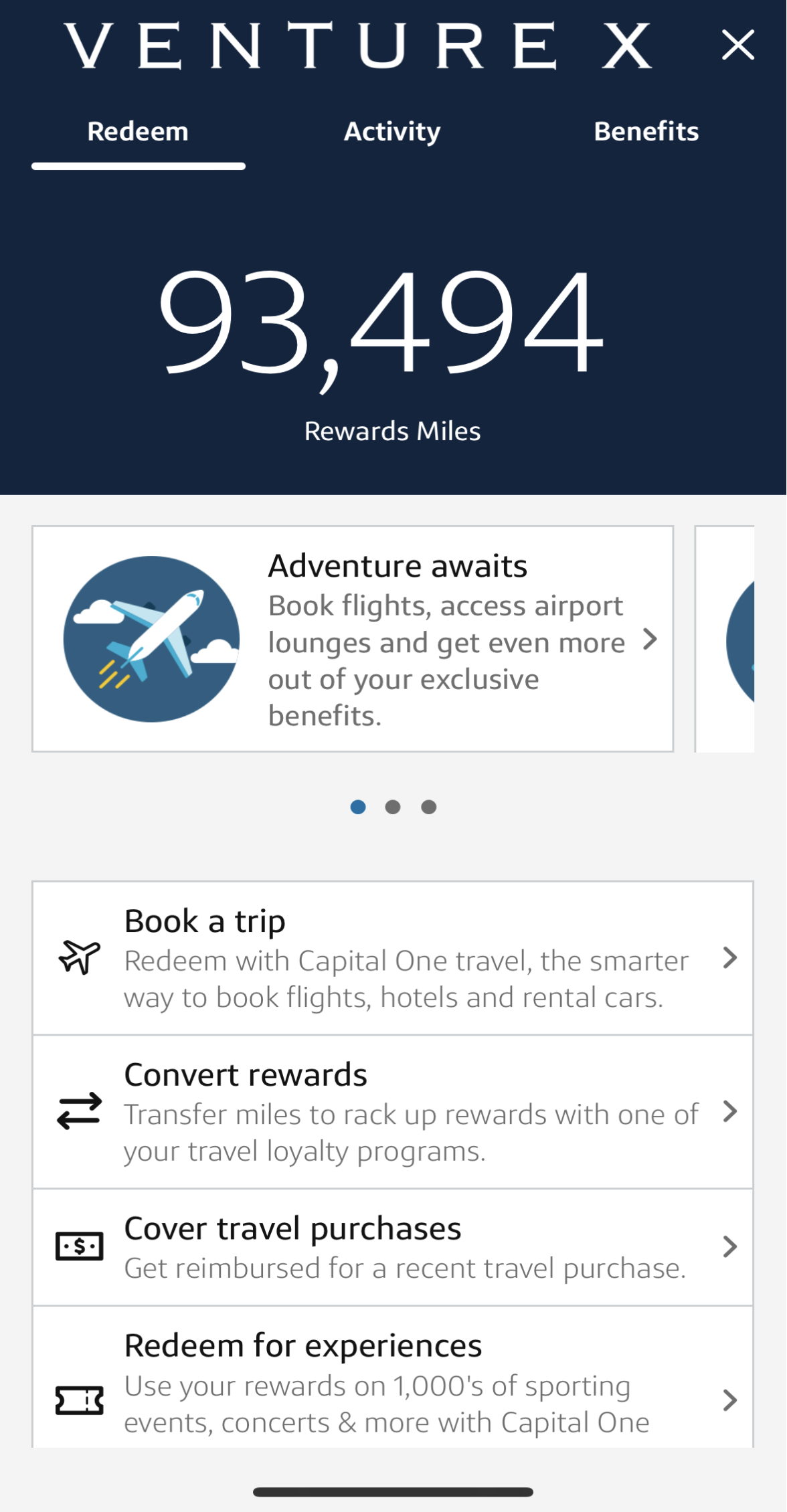

What Are The Redemption Options?

Each time you use the card, you will earn miles. The miles you earn will depend on the purchase you are making. For example, hotels and car rentals earn 10 miles and other purchases will earn you 2 miles for every dollar.

One of the ways you can redeem your miles is to transfer the miles with a 1:1 ratio. You use 50,000 miles for business flights to South America or 7,500 miles for economy flights to Hawaii. Redeeming your flights for travel and airlines is one of the most lucrative ways to redeem your points.

Capital One also has more fixed value redemptions such as redeeming points for gift cards. They will be 1 cent per mile. You can also redeem them for cashback at 0.5 cents per mile. If you don’t want to use the loyalty program for travel, you can also pay off travel you already took for 1 cent per mile.

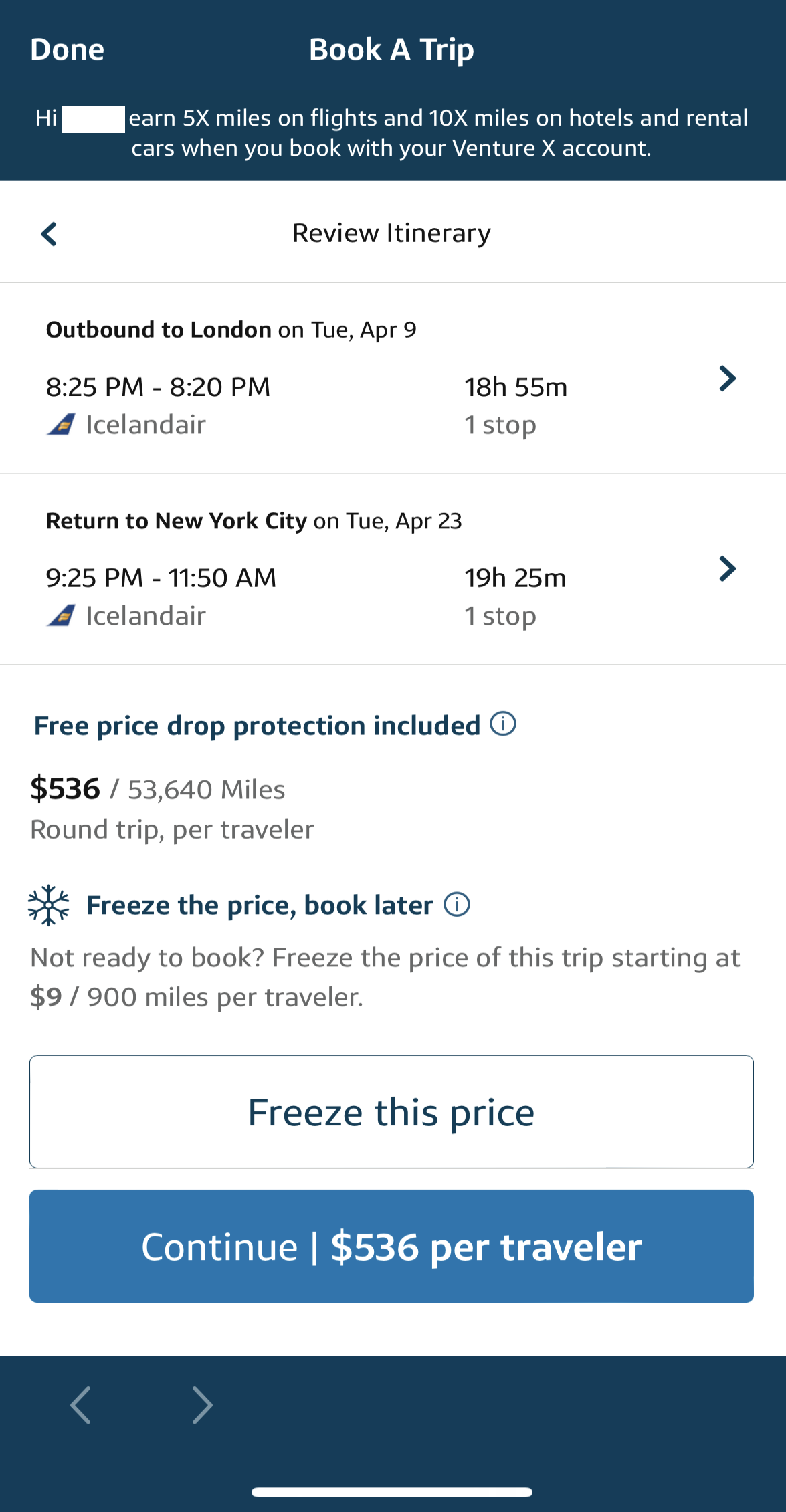

How To Apply For Venture X Rewards Card?

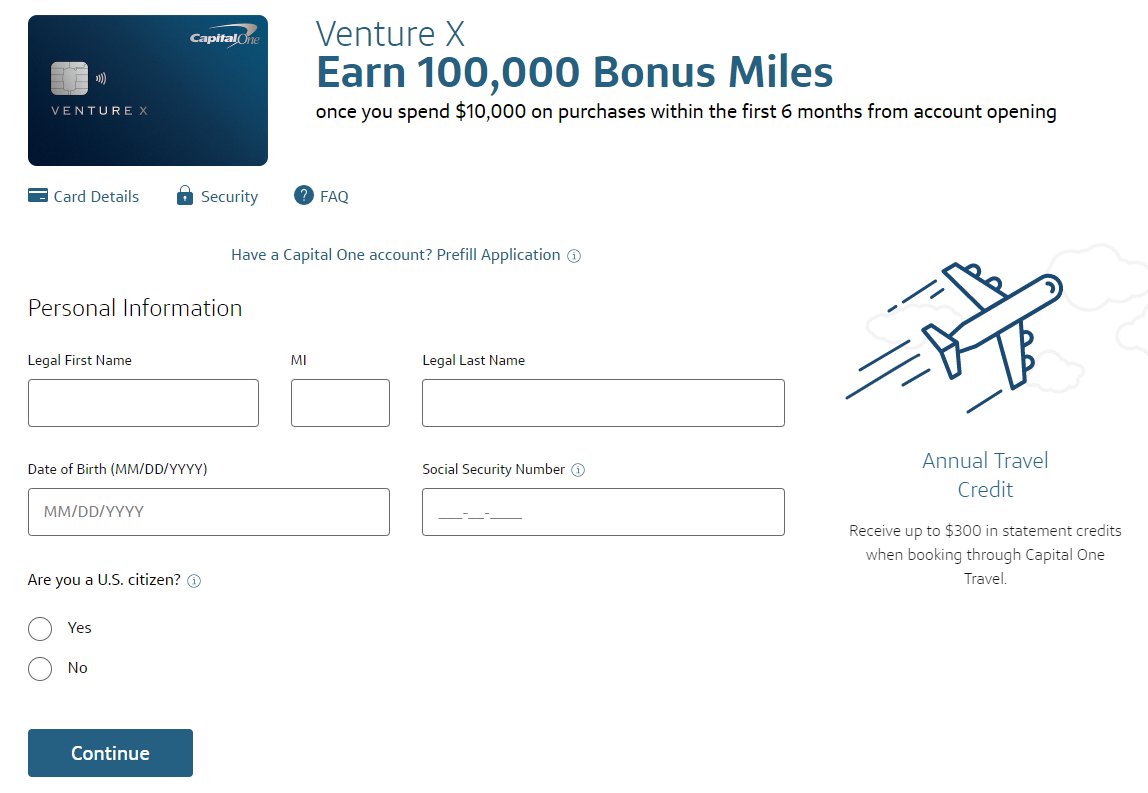

1. You can apply for the card through the Capital One website just like you would any other Capital One Credit Card. Make sure you have all your personal information available and make sure you have photocopies or pictures of your identification documents.

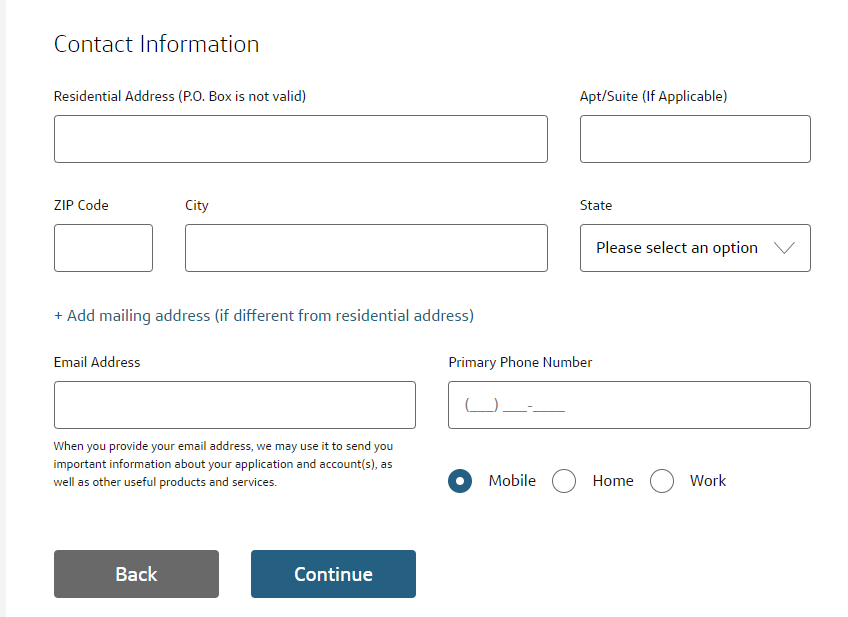

2. Once you’re ready to apply, you can start with the first page of the application where you will enter your personal information. This includes your name, date of birth, address, and telephone number. You will need to enter your social security number so that the company can check your credit score.

Make sure all these fields are correct so that you always get the most up-to-date information regarding your account and your card.

3. Then, you'll need to fill some financial information such as your job, expected expenses on your card and your annual income.

4. You'll have the option to add additional users, if you would like to do that so you need to add their details as well:

5. The last step is to review the terms and approve it. Capital One might ask for your passport or another government-issued ID.

Top Offers

Top Offers

Top Offers From Our Partners

How To Maximize The Venture X Card?

It's important to maximize benefits in every card you use, especially when it comes to premium cards such as the VentureX card:

- Get the statement credit. Each year, you will be able to get a $300 statement credit if you spend a certain amount of money. Getting and using the statement credit is the best way to make sure your annual fee is covered since the annual fee is just a bit higher at $395.

- Use your miles wisely. There are some ways of redeeming points that are more lucrative than others. For example, cashback only gives you 0.5 cents per mile by travel, and gift cards give you 1 cent per mile.

- Sign up for the card during a bonus. From time to time Capital One will have welcome bonuses that give you miles if you spend a certain amount of money during the first 3 months. Make sure to get the card during this time so you get more miles at the beginning to use for travel and other purchases.

How It Compared To Other Premium Travel Cards?

The Capital One Venture X Rewards Credit Card holds its ground well in comparison to other luxury travel cards in the market.

When pitted against the Platinum Card from American Express, which carries a hefty $695 annual fee, the Venture X stands out for its more accessible pricing. While the Amex Platinum provides extensive airport lounge access and a broader range of benefits and statement credits, the Venture X strikes a balance by offering practical perks and travel rewards without the same level of annual fee commitment.

The Chase Sapphire Reserve, another prominent player in the premium card category with a $550 annual fee, offers great bonus points on travel and dining but lacks the same simplicity in earning and redeeming rewards as the Venture X.

In Which Cases It’s Better to Skip?

This card is better to skip if you are wanting a card that gives you extreme perks with one airline instead. This card does not give you extensive loyalty to one airline, so you will not be able to earn points with one airline and use them each time.

Also, cardholders who aren't flying frequently and can't leverage the benefits this card offers, may want to shop around for a different travel card.

Compare The Alternatives

There are other travel cards worth mentioning, here are some of our best premium travel credit cards:

|

|

| |

|---|---|---|---|

The Platinum Card® from American Express | Chase Sapphire Reserve® | Capital One Venture X Rewards | |

Annual Fee | $695. See Rates & Fees | $550 | $395 |

Rewards |

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. | 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

Welcome bonus |

80,000 points

80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership

|

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Foreign Transaction Fee | $0. See Rates & Fees | $0 | $0

|

Purchase APR | 21.24% – 29.24% APR Variable | 22.49%–29.49% variable | 19.99% – 29.99% (Variable) |

FAQ

The Venture X is one of the best cards if you have excellent credit – so your income will be a factor for consideration, but it will not be the sole factor.

If proof of income is required to support your application, the card issuers will contact you with a list of acceptable documents.

Capital One requires that you complete a full application for the Venture X, which will involve a hard credit pull.

You can expect an initial credit limit of $5,000 to $30,000 with the Capital One Venture X.

The average value of Capital One miles is one cent per mile. This means that 10,000 miles would be worth $100. However, it may be possible to get a higher redemption rate with partner programs.

Compare Capital One Venture X Card

The Venture X card outshines the Venture card with superior rewards and premium travel perks. Is It worth the annual fee difference?

The Amex Platinum wins when it comes to redemption options and protections, but the Venture X is cheaper and offers great travel benefits.

Amex Platinum Card vs. Capital One Venture X: Which Card Is Best?

While Chase Sapphire Reserve offers better protections and redemption options, Venture X is cheaper and offers premium travel benefits.

Chase Sapphire Reserve vs. Capital One Venture X: Which Card Is Best?

The Venture X card offers better travel perks than the Sapphire Preferred, such as annual credit and lounge access. But is it worth the fee?

Capital One Venture X vs. Chase Sapphire Preferred: Which Card Is Best?

The Venture X offers better travel rewards than the Amex Gold but is less appealing if you're looking for everyday spending rewards.

Amex Gold Card vs. Capital One Venture X : How They Compare?

While having the similar annual fees, the Capital One Venture X offers more cashback for the same spend and better travel perks

U.S. Bank Altitude Reserve Visa Infinite vs. Capital One Venture X: How They Compare?